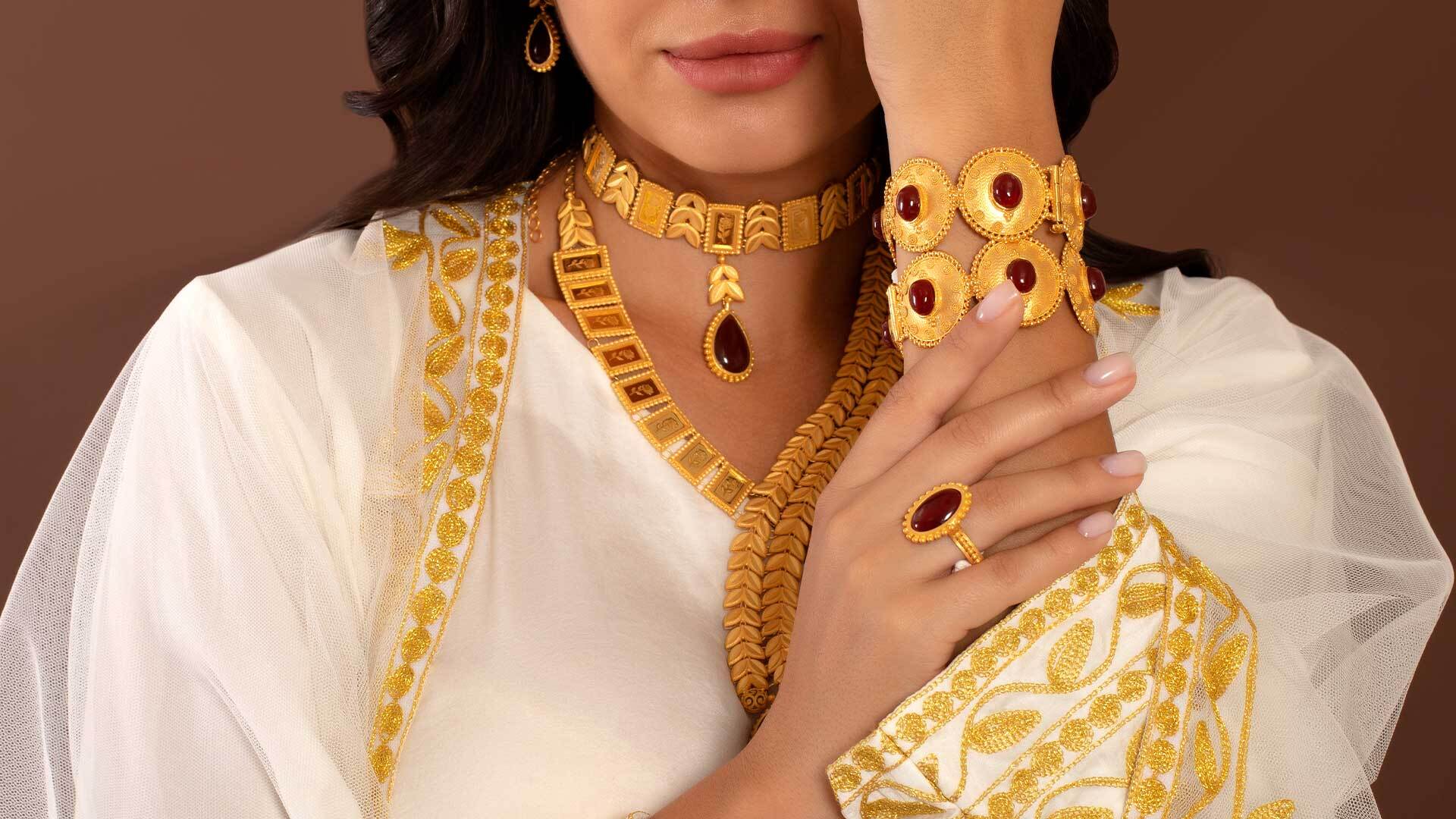

Revealing the Best Places to Acquire Gold Jewellery Dubai

Revealing the Best Places to Acquire Gold Jewellery Dubai

Blog Article

Understand the Conveniences of Investing in Gold Jewellery as a Financial Asset

Gold jewelry has actually long been viewed as more than plain adornment; it stands as a robust financial possession with diverse advantages. Integrating gold jewelry into a varied portfolio can reduce risks associated with market changes. Beyond its economic advantages, the emotional and cultural value of gold jewellery adds layers of worth.

Historical Value Retention

Just how has gold managed to preserve its appeal and value throughout centuries? The long-lasting charm of gold can be connected to its inherent high qualities and historical value. As one of the earliest metals to be found and made use of by people, gold has actually been admired for its rarity, pliability, and glossy elegance. Its unique homes have enabled it to work as an icon of riches and power throughout numerous worlds, from ancient Egypt to the Roman Realm and beyond.

Historically, gold has played a crucial duty in financial systems as a medium of exchange and a requirement for currencies. This long-lasting organization with monetary systems underpins its viewed security and integrity as a shop of value. Unlike various other commodities, gold does not corrode or stain, which ensures its durability and sustained demand.

Culturally, gold jewelry has represented both individual adornment and a concrete asset that can be given through generations, protecting wide range and practice. Its worth retention is additional bolstered by its global recognition and approval, going beyond geographic and cultural borders. These attributes collectively contribute to gold's capacity to preserve its appeal and relevance as a beneficial financial possession in time.

Hedge Against Inflation

Gold jewelry works as an effective inflation-hedge, using defense versus the erosive effects of rising rates. As rising cost of living deteriorates the buying power of currency, concrete assets like gold maintain their innate worth, making them a reliable store of riches. Historically, gold has demonstrated strength during periods of economic instability, as its price often rises in feedback to inflationary stress. This characteristic makes gold jewelry not only an icon of deluxe however likewise a calculated monetary asset for preserving riches over time.

The long-lasting charm of gold as a rising cost of living hedge is rooted in its scarcity and universal acceptance. Unlike fiat currencies, which can be based on control and decline by governments, gold's value is inherently stable. Its restricted supply guarantees that it maintains value, while its universal worth includes in its appeal as a guard against inflation. Investors seeking to expand their portfolios often turn to gold jewelry to offset the threats related to money decline and economic chaos.

Easy Liquidity Choices

Among the considerable advantages of purchasing gold jewellery is its easy liquidity. Unlike several other forms of financial investment, gold jewelry can be swiftly transformed into money. This particular provides it an ideal alternative for people looking for an economic possession that can be conveniently accessed throughout times of urgent demand. The international market for gold guarantees that there is always a need, which facilitates smooth purchases. Gold jewellery can be marketed or pawned at regional jewellery shops, view website pawnshops, or via online platforms, offering multiple methods for liquidation.

The procedure of selling off gold jewelry is fairly uncomplicated. Jewellery items are commonly appraised based upon their weight and purity, with the existing market price for gold determining their cash worth. This standard and clear approach of appraisal help in attaining reasonable prices, minimizing the threat of economic losses throughout liquidation. The appeal of gold jewelry check here in cultural and economic contexts worldwide improves its resale worth, guaranteeing that it stays a robust economic asset.

Profile Diversification

Integrating gold jewelry right into a financial investment profile can offer considerable diversification advantages. This precious steel usually acts in different ways from other asset classes, such as supplies and bonds, which are at risk to market volatility and economic shifts. Gold's special properties enable it to serve as a hedge against inflation and money variations, thus supplying stability when conventional possessions falter. By integrating gold jewellery, investors can alleviate risks and potentially boost the overall performance of their portfolios.

Gold jewelry is not just a substantial property however also retains intrinsic worth, independent of economic market problems. Unlike paper properties, which can come to be worthless in extreme situations, gold has a historical track record for preserving wealth.

In addition, gold jewelry's global appeal and demand make certain liquidity, allowing financiers to rapidly convert their holdings right into money if required. This liquidity can be crucial for rebalancing portfolios or seizing brand-new investment opportunities. Eventually, incorporating gold jewelry offers a calculated advantage, enhancing portfolio durability and cultivating long-term economic safety and security.

Emotional and cultural Worth

The sentimental and social worth of gold jewelry is a considerable variable that sets it find out this here apart from other types of financial investment. Unlike bonds or supplies, gold jewellery typically transcends simple monetary well worth, personifying ingrained cultural traditions and individual memories.

Moreover, gold jewelry commonly lugs sentimental worth, passed down with generations as valued antiques. These pieces can evoke domestic and personal backgrounds, offering as tangible links to the past. The emotional accessory related to gold jewellery can make it a cherished asset, valued not simply for its monetary worth but for its capability to communicate and maintain household narratives and customs.

Conclusion

Investing in gold jewellery supplies significant advantages as a financial property. Gold's historic value retention and its duty as a hedge versus rising cost of living give stability in unpredictable economic problems. Its high liquidity makes certain swift conversion to cash, improving monetary adaptability. Diversity via gold jewelry lowers direct exposure to traditional market risks. The cultural and sentimental worth attached to gold pieces improves their investment appeal, making them a purposeful enhancement to both monetary profiles and family members legacies.

Beyond its economic benefits, the cultural and emotional significance of gold jewellery includes layers of value (gold jewellery dubai). Gold jewelry can be sold or pawned at local jewelry stores, pawnshops, or with online systems, offering numerous opportunities for liquidation

The popularity of gold jewellery in economic and social contexts worldwide improves its resale worth, making certain that it remains a durable financial possession.

Gold jewellery is not just a tangible property but also retains inherent value, independent of financial market problems. The emotional accessory associated with gold jewellery can make it a treasured asset, valued not merely for its monetary well worth however for its ability to convey and preserve family narratives and practices.

Report this page